CONTENTS

1. What is times interest earned ratio?

2. Formulae

3. Interpretation through example

4. What is a good TIE ratio?

5. Times interest earned ratio and investors

6. Limitations of TIE ratio

What is Times interest earned ratio?

The times interest earned ratio (TIE ratio), also known as interest coverage ratio, is a measure of how effectively a company can pay its interest on outstanding debt.

It is one of the several financial ratios used for analyzing a company.

It simply tells how many times a company can pay its current interest with the available earnings.

Formulae

EBIT = Earnings before interest and taxes

(EBIT is calculated by subtracting the selling, general & administrative (S, G & A) and research & development(R&D) costs from gross profit of a company)

Some companies also use EBITDA (earnings before interest, taxes, depreciation, and amortization) instead of EBIT for calculating the TIE ratio.

In such cases, we get higher times interest earned ratio since EBITDA > EBIT.

Note– All the above-mentioned data can easily be found on a company’s income statement.

Interpretation Through Example

Let us consider two companies, company A and company B.

Suppose, company A has EBIT= 300,000$ for a quarter, but it is liable to a debt payment of 100,000$ per month.

We multiply interest with 3 to calculate interest expenses for the quarter, that is, 3×100,000$ = 300,000$

So, calculated TIE ratio for company A = (300,000$/300,000$) =1

This means that all the incomes generated will be used up solely for the interest payment.

Such a company has a high risk of bankruptcy even if it has a single bad quarter.

Now let us assume that debt payment of company B is the same as company A, that is, 100,000$ per month but its EBIT = 900,000

So, calculated TIE ratio for company B = (900,000$/300,000$) = 3

Thus, we see that company B earns thrice of what it has to pay as interest.

As a result, it can easily take the burden of paying its interest and has a lesser risk of bankruptcy even if it has a few bad quarters.

So, we can see, companies with higher times interest earned ratio can pay their interest more easily and have lesser market volatility.

Related article: How To File Taxes Without a W2 or Pay Stub?

What is a good TIE ratio?

The definition of a ‘good times interest earned ratio’ varies widely for different industries and even for different companies in the same industries.

For public utility companies, a TIE ratio close to 2 is also considered decent because they have predictable long-term incomes, due to certain government regulations.

On the other hand, manufacturing companies are required to have higher TIE ratios, close to 3 as they are more volatile.

Also, companies in the same industry might have very different TIE ratios due to differences in business models.

In general, times interest earned ratio below 1.5 is not at all healthy and anything below 1 is alarming and may result to be catastrophic for a company.

Times Interest Earned Ratio and Investors

Generally, investors check the TIE ratio of a company along with other important financial ratios.

A company having a good TIE ratio is likely to attract more investors.

Large loans may also be sanctioned to the company quite easily.

On the other hand, investors usually don’t prefer companies with lower times interest earned ratio as they have higher chances of failing when it comes to debt payment.

Limitations of TIE Ratio

Times interest earned ratio is usually subject to variations when it comes to the long term.

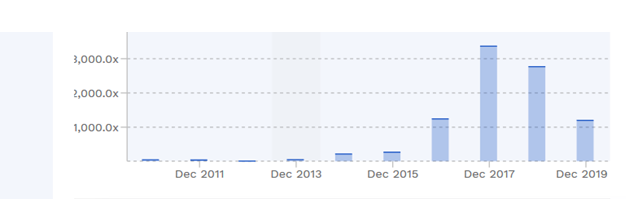

The data of TIE ratio (interest coverage ratio) variations of Facebook are shown below:

You can easily see how irregular it is.

The fluctuations are even higher during times of recession like 2008, or during pandemics like COVID-19.

Also, many companies tend to exclude certain kinds of debt from the interest expenses while calculating their TIE ratio, resulting in higher times interest earned ratio. This may be misleading.

Hence, it is advisable to calculate the TIE ratio independently.

Create your stub now